Who Owns Goodreads?

Who owns Goodreads? If you haven’t Googled it yet, the “About” page on Goodreads won’t give you a straight answer, offering only a “Message from our Co-Founder.” You have to click all the way into the “Careers” page to find a direct statement about who actually owns the platform. Halfway down the page, it says: “As an Amazon company…”

In other words, Amazon owns Goodreads. While direct mentions of its parent company are scarce on Goodreads, Amazon’s fingerprints are all over the “world’s largest largest site for readers and book recommendations.”

Let’s dive into why Amazon bought the book world’s biggest platform.

Who Owns Goodreads?

In 2013, Amazon bought Goodreads for about $150 million. The acquisition called back to Amazon’s roots as a site that, once upon a time, sold only books. By 2013, Amazon was a sales behemoth in both print and ebooks, thanks to Kindle and its self-publishing platforms.

The Goodreads sale initially kicked up such a frenzy that analysts were estimating the sale at a billion dollars. While the final number was a fraction of that, it was still a significant chunk of change. So what did Amazon get for all that Bezos money?

Goodreads Beginnings

Goodreads was launched in 2007 by married partners Otis Chandler and Elizabeth Kaur Chandler. According to Goodreads, Otis said he wanted to recreate the experience of walking into a friend’s living room and checking out their bookshelves. He was also inspired by the bookish blogosphere, where readers were commenting on reviews across blogs. Goodreads was designed to create a platform site for those reviews. Add in the digital book tracking via “shelves,” and the site was born. Goodreads was designed as a “long tail content” site, meaning its value comes from its breadth of content. The site holds millions of reviews about millions of books. Efficient SEO drives most people who search “Book Title + review” to Goodreads.

The Chandlers’ approach worked. By the time Amazon came calling, Goodreads had a staff of over 100 and 16 million users. The Chandlers, who stayed on as CEO and Editor-In-Chief after the Amazon acquisition, stepped back from Goodreads leadership in 2019.

What’s in it for Amazon?

Kindle Integration

The Kindle/Goodreads integration is one of the major selling points for both Amazon and Goodreads. In his 2016 HustleCon talk, Otis said it was the ability to integrate the Goodreads social platform into the Kindle that made the acquisition “exciting,” (that, and the millions of dollars Amazon put on the table).

After acquiring the site, Amazon added a new social aspect to the Kindle reading experience. New Kindle users are now prompted to link their Goodreads account. Starting with the Kindle Home screen, the Homepage loads a user’s “to-read” list. Kindle highlights are automatically added to Goodreads and a user can choose to post live updates on the reading progress from Kindle to Goodreads. The Kindle prompts you to rate your read on Goodreads as soon as you reach the end of the book. More Kindle integration may be coming. The Goodreads Career page touts “We are deeply integrated with Kindle and have exciting opportunities to invent the future of reading in partnership with Kindle, Audible, Alexa, and more.”

The Kindle integration may be a big reason behind the growth of Goodreads. When Amazon bought Goodreads back in 2013, the site had about 16 million users around the world. By July 2019, users had reached 90 million, according to Statistica.

Goodreads as Storefront

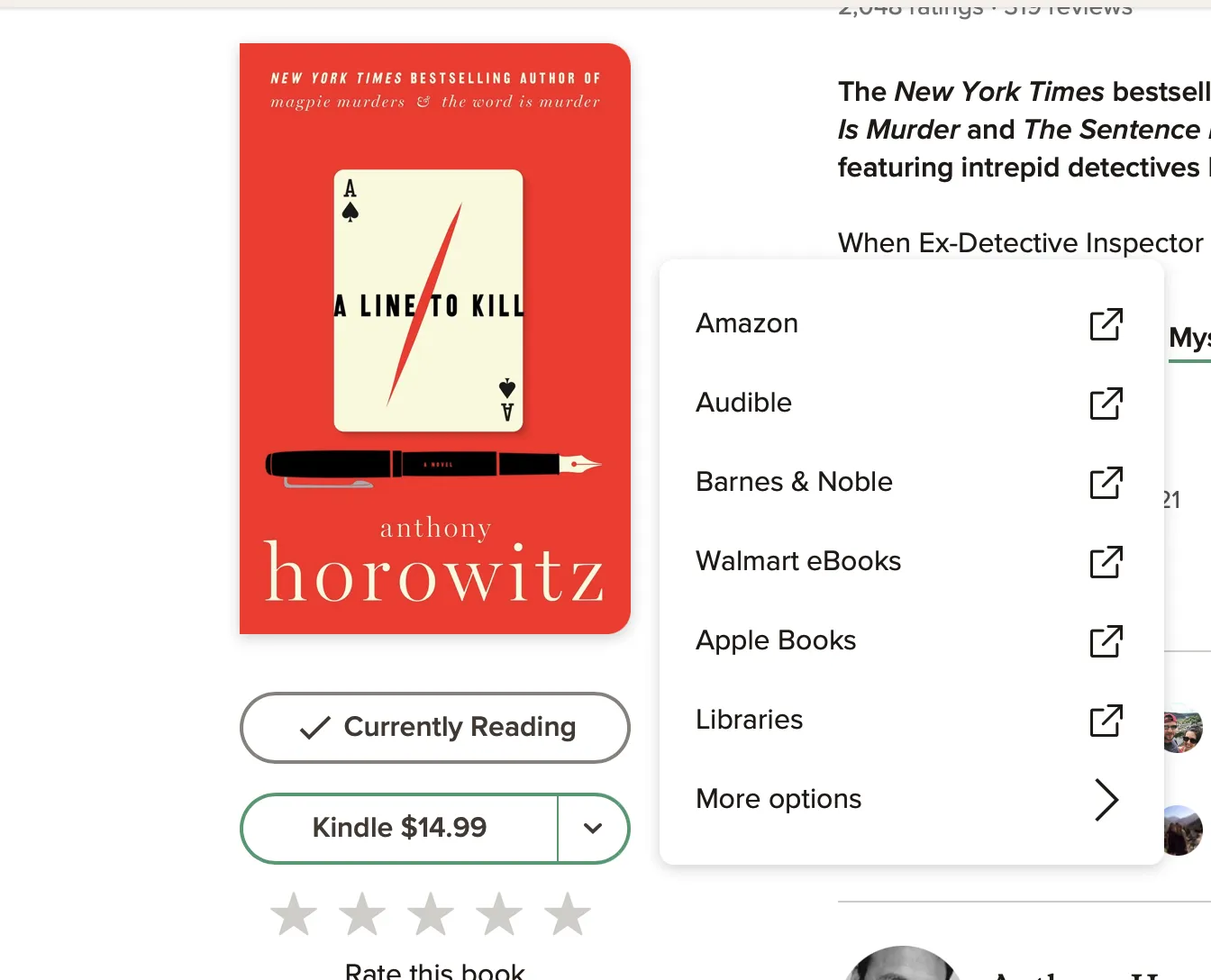

Amazon is the biggest bookseller in the world, and they’ve turned Goodreads into a highly personalized storefront. Whenever you click on a book’s Goodreads page, the most prominent “buy “option is Kindle if the version is available. Expand for more options and you’ll get Amazon and Audible (another Amazon company).

(If you go into Settings, you can add and rank more online buying options, but it’s not an intuitive switch). Now, most book sites link to Amazon to generate profit, but Goodreads has an advantage with the sheer number of users who are actively seeking their next read on the site.

Goodreads benefits Amazon’s publishing side too. Amazon runs its own publishing business and platforms. The company currently has 15 imprints, ranging from Women’s Fiction to Sci-fi to Young Adult. Thanks to Kindle, its imprints are major players in the ebooks market. According to Quartz, 9.5% of the ebooks sold in the U.S. in 2017 came from Amazon’s imprints. Conveniently, the banner ads on Goodreads often advertise Amazon’s own books. Goodreads ads also push Prime and Kindle Unlimited, promoting that both programs offering access to “free” ebooks based on membership fees.

Goodreads is a Data Goldmine

There are 90 million Goodreads users flagging books as to-read and read and doling out several galaxies-worth of stars as they rate and review books. All those clicks give insight into individual reader preferences and potentially create the reader’s own custom-designed literary concierge that can predict your next five-star read. Supposedly, Goodreads is using machine learning to make recommendations. However, if you’ve ever puzzled over Goodreads “personalized recommendations,” it’s clear that Goodreads hasn’t put much effort in that direction. (Good thing there are actual humans at TBR who can help a reader out.)

While individual insights are nice (and under-used), the real value is tapping into the reader hive mind. Amazon can mine millions of readers’ shelves to see what is trending in books and reading habits. Goodreads could reveal fascinating insights into reader habits during the pandemic. How many readers shelved cozies? Was there a rise in travelogues? Bookworms everywhere want to know! For now though, Goodreads seems to be keeping that most valuable data under wraps.

Your Attention, Please: The Value of Reader Interaction

Ultimately, a huge value in Goodreads is the reader interaction. As noted above, that interaction breeds tons of valuable data. But just having your attention is valuable too. Michael Goldhaber predicted the massive currency of screentime way back in 1997 when he coined the “attention economy.” The term refers to the idea that our attention is a scare resource — you can only process one thing at a time. Goldhaber said of our mental bandwidth, “Ultimately then, the attention economy is a zero-sum game. What one person gets, someone else is denied.”

By acquiring Goodreads, Amazon made sure it had access to the most active readers’ attention. As The Atlantic noted back in 2013, “When all is said and done, in the world of books, Goodreads is just about as influential as Facebook.” Whether you’re adding books to your shelves, interacting with reviews, or clicking “buy,” Amazon has your attention.

When Amazon Wins, What Do Readers Lose?

By buying Goodreads, Amazon has control over the largest reader platform. It get more sales, more data, and more clicks. It also quashes the competition for social book platforms. Why? Well, it’s extremely hard to make money off a book site unless you link to Amazon. And Amazon is unlikely to grant affiliate status to true Goodreads competitors. There are worthy alternatives out there, but none have been able to match the size of the Goodreads user base. Plus, Amazon has locked down the Goodreads API since 2020, making it near impossible for third party apps to build off the site’s experience.

The New Statesman noted that without competition “Amazon has very little incentive to improve Goodreads while no serious competitor exists and its ‘core experience’ is good enough.” That may be why the interface is notoriously clunky and the “Ideas” section of the Goodreads website seems more like a graveyard than a working collaboration. But with 90 million readers, I hold out hope that Goodreads will come up with something brilliant out of all those starry shelves. After all, as co-founder Otis Chandler said at HustleCon, Goodreads “is just scratching the surface…of the future of digital reading.”